Menu

Weight loss

Hormones

Sex

EXPLORE

MEET NU IMAGE MEDICAL

TREATMENTS

MEET NU IMAGE MEDICAL

TREATMENTS

MEET NU IMAGE MEDICAL

Is Gastric Bypass Covered by Insurance?

With obesity on the rise, it comes as no surprise that many people consider gastric bypass surgery. Gastric bypass surgery is very expensive, often costing patients anywhere between $7,400 and $33,000. With such a high price tag, some people may wonder if bariatric surgery is covered by their insurance.

Many insurance companies cover gastric bypass surgery, but you may need to meet specific criteria for the surgery to be covered. Many insurance companies require that you have a BMI of 35 or above for them to cover your gastric bypass surgery. Some insurance companies require that you have a comorbidity or preexisting condition for them to cover the surgery.

However, 23 states in the Continental United States require that all small group, family, and individual plans cover gastric bypass surgery. These states include Arizona, California, Colorado, Delaware, and Hawaii. Other states that require insurance to pay for gastric bypass surgery include the following:

-

Iowa

-

Illinois

-

Maine

-

Massachusetts

-

Maryland

-

Michigan

-

New Hampshire

-

Nevada

-

New Mexico

-

New Jersey

-

New York

-

North Carolina

-

North Dakota

-

West Virginia

-

Wyoming

Under the Affordable Care Act, three states require that weight loss surgery be covered by some but not all insurance policies. Georgia, for example, instituted a law in 1999 stating that morbid obesity must be covered by insurance.

Indiana instituted a state law in 2000 stating that all insurance companies must cover morbid obesity. A 2000 law in Virginia mandates that at least one plan in all insurance companies offers coverage for morbid obesity. Medicaid and Medicare offer coverage for some weight loss procedures, such as laparoscopic banding surgery and gastric bypass surgery.

According to Medicine.gov, with original Medicare, it can be hard to predict what your costs may be before you get the procedure. The reason for this is that you likely will not know what specific services you need until you consult with your provider. It is possible to figure out how much you will have to pay out before you have the surgery.

Medicare will pay for weight loss surgery as long as you meet certain eligibility criteria. First of all, you must be morbidly obese to qualify for bariatric surgery.

You can do this in a number of ways. First, talk to your doctor, medical facility, or hospital where you plan to have the surgery. Any one of these may be able to tell you how much you may have to pay out of pocket. If your insurance company does not pay for gastric bypass surgery, you can contact one of their insurance representatives or employers and ask if they are able to add gastric bypass benefits to their plan, according to Old Delmar Surgical.

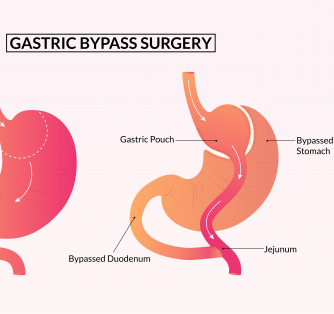

Of course, it is important to understand what gastric bypass surgery is. Gastric bypass surgery is a procedure which changes an individual’s digestive process in the gastrointestinal or GI tract. This helps a person lose weight. There are two different types of gastric bypass surgery. The first approach involves reducing the size of one’s stomach, so you can no longer overeat.

Because of this, you are only able to eat a certain amount of food before you begin to feel full. The second type of gastric bypass surgery limits the number of calories and nutrients your body is able to ingest. But let’s break down the specific types of bariatric surgery.

Sleeve gastrectomy

A sleeve gastrectomy is a procedure in which part of the stomach is removed from the body. The portion of the stomach that remains is in the shape of a small tube. As a result, the stomach cannot hold a whole lot of food.

Roux-en-Y gastric bypass

Roux-en-Y Gastric bypass surgery is a procedure in which your doctor creates a small pouch in your stomach, so you are only able to consume a certain amount of food before you begin to feel full. This procedure creates a Y-shaped portion in the small intestine. This limits the number of calories and nutrients that can be absorbed by the body. The end result is a reduced appetite and a smaller caloric intake.

When you limit your calorie intake, you are able to burn more calories, which facilitates weight loss.

Biliopancreatic Diversion Gastric Bypass

There is also Biliopancreatic Diversion Gastric Bypass surgery. This is a less common gastric procedure, and it is more complex than Roux-en-Y gastric bypass. It primarily limits the amount of food that your body can absorb. It also involves removing the lower part of the stomach. This surgery is typically considered only for patients who are extremely obese.

It is very important to be aware of what insurance companies cover weight loss surgery. Below is a list of some insurance companies and their guidelines regarding gastric bypass surgery.

Aetna

When it comes to insurance, you have more coverage than you may be aware of. Each insurance company has its own guidelines on what it will cover if you plan on having gastric bypass surgery. Aetna covers weight loss surgeries, but Aetna HMO and QPOS plans do not offer coverage for weight loss procedures unless Aetna specifically approves them. If you want to find out if your Aetna plan covers gastric bypass surgery, you should contact the company to see if your policy covers weight loss surgery.

Blue Cross Blue Shield (BCBS)

Anthem Blue Cross and Blue Shield also have their own set of requirements when it comes to gastric bypass surgery. BCBS doesn’t exclude weight loss surgery. BCBS prides itself on the fact that many of its policies support the treatment of morbid obesity. Your employer’s insurance company reserves the right to opt out of weight loss surgery coverage. This saves them money on premiums.

If you find that your insurance provider does not provide coverage for weight loss surgery, contact your insurance provider. BCBS does have some specific requirements for you to qualify for gastric bypass surgery. You must have a body mass index or BMI of 40 or above. You may also qualify if you have a BMI of 35 and have other preexisting comorbidities.

But what exactly is a comorbidity? A comorbidity is two or more preexisting conditions that have the potential to cause harm. Having a comorbidity makes it possible for you to experience complications. You may also need a letter from your primary care physician stating that weight loss surgery is necessary.

If you have BCBS, you should first make an effort to lose weight using other non-surgical methods. You must also be at least 18 years of age to qualify. You need to consult with a weight loss surgeon and have a psychological evaluation under Blue Cross Blue Shield. A nutritional evaluation may also be necessary.

Cigna

Cigna is yet another insurance company that covers gastric bypass surgery. Most of Cigna’s plans cover weight loss surgery, but some policies do not offer coverage for this type of procedure. If your policy covers weight loss surgery, you may need to meet certain pre-approval criteria. According to experts, patients requesting weight loss surgery may need to have a BMI of 40 or above.

If you have a BMI between 35 and 40, you must have a preexisting comorbidity, such as high cholesterol, type 2 diabetes, or heart disease. Other conditions that qualify as comorbidities are obstructive sleep apnea and pulmonary hypertension. Under Cigna’s plan you must also provide proof that you are trying to lose weight using other methods, but have failed in your efforts.

To satisfy this requirement, you must provide “monthly documentation” proving that you are in fact attempting to lose weight using other methods. Such methods may include nutritional programs and exercise regimens. If you want to have gastric bypass surgery, it is important to find out which types of gastric bypass surgeries your plan covers. Cigna covers gastric bypass, gastric bands, gastric sleeve surgery, and vertical banded gastroplasty.

Each insurance company is different, and keep in mind that not all weight loss procedures may be covered under your plan. Some insurance companies do not cover gastric bypass that is combined with a gastric band. Loop gastric bypass, intra-gastric balloons, and Fobi-Pouch are often excluded from a company’s coverage. Be aware that you do not need to select a provider that is in your network. You can pay out of pocket if you choose a provider that is out of network. However, the cost of weight loss surgery is very high and may create a financial burden.

This is especially true if you are on a fixed income or don’t have a lot of money. However, it’s important to note that some insurance companies don’t cover weight loss surgery, because they don’t deem it as being medically necessary. In many cases, weight loss surgery is performed with the intention of improving one’s appearance.

However, if weight loss surgery is necessary to save your life, check with your insurance company to explore the options you may have. Having a life-threatening condition may make the procedure medically necessary.

Keep in mind that there may be cases when an insurance company refuses to pay for gastric surgery. If you encounter this situation, you may be able to take advantage of payment plans. These can be paid off over a certain period of time, but the goal is to make sure that you stay healthy. If gastric bypass surgery is necessary to achieve this goal, you may want to explore financing plans.

There are other benefits to gastric bypass surgery that may make it a good medical option that promotes good health. Some weight loss procedures can cause a remission in diabetes.

15 Sources

Nu Image Medical has strict sourcing guidelines to ensure our content is accurate and current. We rely on peer-reviewed studies, academic research institutions, and medical associations. We strive to use primary sources and refrain from using tertiary references.

https://www.goodrx.com/conditions/weight-loss/bariatric-surgery-costs

https://wellbe.me/how-to-get-insurance-to-pay-for-bariatric-surgery/

https://www.webmd.com/connect-to-care/bariatric-surgery/what-is-bariatric-surgery

https://wellbe.me/how-to-get-insurance-to-pay-for-bariatric-surgery/

https://www.webmd.com/diet/what-is-morbid-obesity

https://oldedelmarsurgical.com/blog/you-can-afford-weight-loss-surgery/

https://my.clevelandclinic.org/health/treatments/17163-lap--band-surgery

https://www.humana.com/medicare/medicare-resources/bariatric-surgery

https://my.clevelandclinic.org/health/treatments/22931-gastric-sleeve-surgery

https://oldedelmarsurgical.com/blog/you-can-afford-weight-loss-surgery/

https://www.matherhospital.org/weight-loss-matters/exercise/the-latest-fitness-trends/

https://pubmed.ncbi.nlm.nih.gov/25008469/

https://www.experian.com/blogs/ask-experian/medical-bill-payment-plans/

https://stanfordhealthcare.org/medical-treatments/g/gastric-bypass-surgery/types.html

This article is for informational purposes only and does not constitute medical advice. The information contained herein is not a substitute for and should never be relied upon for professional medical advice. Always talk to your physician about the risks and benefits of any treatment. Nu Image Medical may not offer the medications or services mentioned in this article.